Is Black Friday advertising cooked?

Gupta Media

We're building the world's most ambitious advertising agency.

December 07, 2023

New data shows shoppers are buying earlier than ever. Smart marketers are already adjusting their plans.

![]()

Once upon a time, Black Friday was a retail jackpot: One shot, all-in. It hasn’t been that way for some time—but this year suggests a new paradigm, fully in bloom, that marketers have been slow to recognize.

It’s not just the creep of Black Friday into Thanksgiving day, or the expansion of BF into BFCM and then Cyber Week. This year, the nation’s biggest retailers are referring not just to T-5 (the so-called Turkey Five: Thanksgiving, Black Friday, Saturday, Sunday, and Cyber Monday) but to T-11. By the time Black Friday rolls around, discounts have been available for days—if not weeks.

Shoppers are beginning to catch on, too. Unless you’ve been under a rock, you’ve likely seen the viral TikTok video shot by a customer at a big-box retailer: The shopper digs behind the Black Friday price card on a television display, and pulls out the old sale card behind it—for the exact same price. It’s a meme that illuminates a broader collective vibe shift: Culturally, the rush of Black Friday seems to be fading. Is it cooked?

The shape of Black Fridays to come

Let's not get ahead of ourselves: Black Friday is not dead yet. This year, shoppers in several Massachusetts suburbs were stranded in traffic jams for hours, in one case jamming the roadways outside an outlet mall until the local sheriff pleaded with residents to stay home. Shopper visits on Black Friday were up 4.6% year over year, according to Sensormatic, but sales volume—at just over $9 billion—was up just 1% compared with 2021. And those numbers obscure the overall trend, which shows dropping foot traffic in brick-and-mortar retail on Black Friday, as purchases migrate online. Once shoppers are online, marketers have been increasingly successful in getting them to buy sooner. Consumers are also, increasingly, buying on their phones: Smartphone sales were up 10% year over year, now accounting for more than half of all online sales overall.

History may show that 2023 was the year the dam broke in terms of moving sales back by not just hours or days but weeks: Holiday shopping in 2023 appears to have started, essentially, in early November—and even earlier if you factor in Amazon’s October Prime Day, held this past October 10-11.

GET SMARTER: How much do TikTok ads really cost in 2023?

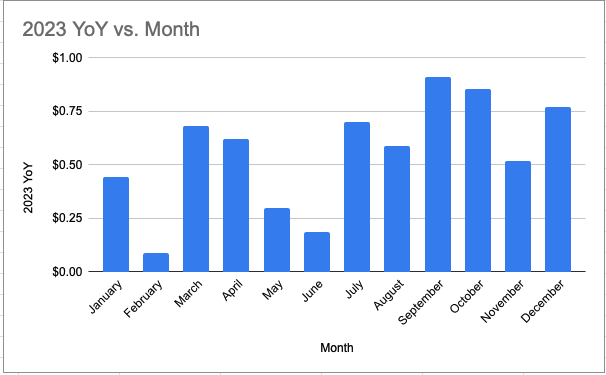

On Gupta Media's Social Media CPM Tracker, we’re seeing Meta advertising rates — which tend to track with consumer demand — stay relatively flat in November, as compared with steeper increases in September, October, and December. That’s consistent with the idea that online marketers have squeezed nearly as much juice as possible out of their campaigns in the run-up to Black Friday and Cyber Monday — and are now beginning to expand their prospecting earlier into the fall.

CHART: Year over year CPM growth for Meta advertising, by month. (The amount corresponds to the year-over-year delta only.) Source: Gupta Social Media CPM Tracker, 2023.

Should advertisers deal earlier?

That trend is also consistent with what we predicted in our State of Social Media CPM Report this year, when we identified a period of increased consumer demand coinciding with relatively lower CPM rates in the November weeks ahead of Black Friday. This year, CPM rate increases suggest marketers are rallying to those conditions and competing for market share well in advance of BFCM. Which means: Get ready for even earlier deals. We expect to see this trend continue, and accelerate, in the coming years, as marketers react to the incentive of cheaper advertising rates—as well as to the realization that Black Friday’s halo effect is getting wider.

But is the Black Friday halo also getting more shallow? In some cases, our media buyers are seeing a misalignment between advertisers and consumers, with advertisers beginning to over-value Black Friday in their media plans. CPMs are priced for doorbuster-type sales, but shoppers aren’t converting at rates that justify the expense. For now, that’s a rogue trend in what’s turning out to be a flat year. But in the future, we’d expect to see more brands shifting spend earlier in the holiday cycle—and being more wary of placing all their eggs in the BFCM basket.

What do you think: Is Black Friday cooked? Join the conversation.

The Arbiter is a series of informed opinions, strategic outlooks, analytics-backed predictions, and tactical briefings from Gupta Media. Subscribe via email, Substack, or LinkedIn.